Revolutionizing Sustainability: The Future of Closed-Loop PET Recycling in India

- Rehman Shaikh

- Sep 3, 2025

- 14 min read

Updated: Sep 5, 2025

If you are interested in applying to GGI's Impact Fellowship program, you can access our application link here.

Abstract

The country produces 9.9 million tonnes of plastic waste each year - PET bottles are the main contributor due to their widespread use in beverages and packaging. While an extensive informal sector drives a high PET collection rate, closed-loop recycling - recycling PET bottles into new bottles - is limited to just 27% of the 1.63 million tonnes of recycled PET used in bottle-to-bottle applications. This paper reviews the impacts and prospects of closed-loop PET recycling in India, highlighting key challenges: Neoliberal policy implementation has resulted in inadequate infrastructure for food-grade recycled PET (rPET) contamination, limiting market demand. In line with global leaders like the EU and Japan, we propose deposit return schemes (DRS), chemical recycling, mandatory recycled content, and extended producer responsibility (EPR). Charts illustrate waste flows, recycling rates & market growth projections. Data gaps in the informal sector and high technology costs are among the limitations. This study is an orientation document for all stakeholders to promote India's circular economy.

PET Waste Flows in India (2023): Despite a 95% collection rate, only 27% of recycled PET

goes into closed-loop bottle-to-bottle recycling, while the majority is downcycled into textiles and other low-value products.

1.Introduction

Context and Motivation:

With a population of over 1.4 billion people, India produces about 9.9 million tonnes of plastic waste a year - of which polyethylene terephthalate (PET) bottles account for about a third due to their use in beverages, edible oils, household products and pharmaceuticals. Rising urbanisation, consumerism and packaged goods demand are expected to drive PET waste generation up to 2030 at a compound annual growth rate (CAGR) of 7%. India has a global benchmark of a 95% PET recycling rate, above the world average of 9%, the European Union's 48.3%, and the United States' 31%. Yet of the 1.63 million tonnes of recycled PET only 0.45 million tonnes (27%) are recycled in closed-loop, bottle-to-bottle recycling, and most are downcycled into lower value products such as polyester fibers, strapping, or sheets.

For India's circular economy ambitions, closed-loop recycling is crucial for Sustainable

Development Goal 12 (Responsible Consumption & Production). It lowers emissions of

greenhouse gases (GHGs) by up to 60% (1.4 kg CO2 / kg for rPET versus 3.4 kg CO2 / kg for

virgin PET production). The 2022 Plastic Waste Management Rules require 30% recycled

content by 2025 and 60% by 2029 in PET bottles - clear policy intent. Still, barriers including

inadequate infrastructure for food-grade rPET, contamination of waste streams, weak market incentives, and inconsistent state policy enforcement keep progressing. With over 50 million waste pickers across India, the informal recycling sector has a 95% PET waste collection strength but lacks integration with formal systems, limiting closed-loop outcomes.

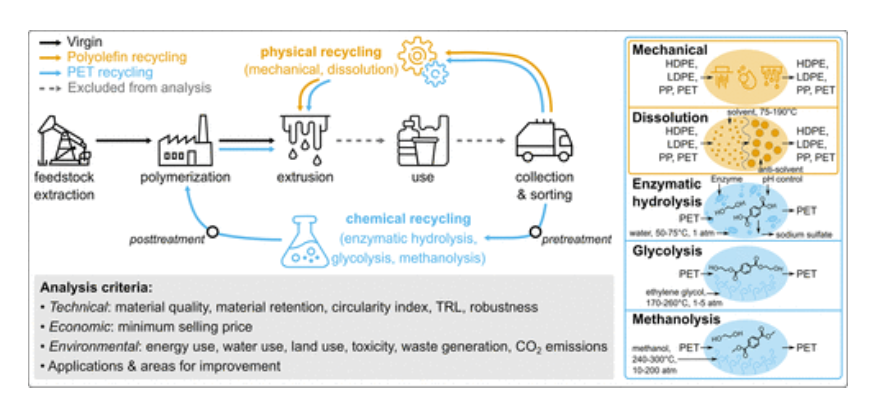

Image 1 - A schematic overview of closed-loop recycling pathways (mechanical, dissolution,

chemical) for plastics like PET, HDPE, LDPE, and PP, assessed against cost, technical

performance, and environmental impact.

Image 2 - A lifecycle flowchart of plastic recycling showing virgin production, collection, and sorting, with pathways for physical (mechanical, dissolution) and chemical (enzymatic

hydrolysis, glycolysis, methanolysis) recycling, evaluated on technical, economic, and

environmental criteria.

This analysis covers recycling technologies, including plastic bale recovery and pellet extrusion with repolymerization where applicable. It excludes the use of the original plastic's production, use, and collection. The virgin polymers are evaluated from fossil fuel extraction to their use and disposal.

This consulting-style research paper diagnoses such challenges, points out root causes, and offers actionable solutions to scale closed-loop PET recycling in India. Benchmarking India against world leaders like Japan and the EU, leveraging emerging technologies and policy frameworks, we provide a roadmap for stakeholders including policymakers/business leaders, NGOs, and communities to reduce environmental impacts, create economic opportunities, and position India as a global leader in sustainable PET management. Three charts show PET waste flows, recycling rates, and market growth analysis. The study also addresses implementation issues, noting fellows can undertake pilots independently with limited support from GGI.

2.Overarching Issue

The PET collection rate in India's informal sector masks a critical challenge: Closed-loop

recycling is only partially adopted today. Only 27% (0.45 million tonnes) of recycled PET is

used for food-grade rPET applications, and the remaining 73% is downcycled into textiles,

strapping, or other low-value products. Downcycling undermines the circular economy by decreasing material circularity and increasing energy use - textile production uses 30% more energy than bottle production. With this open-loop recycling model, virgin PET continues to be used at a rate of 3.4 kg CO2 / kg compared to 1.4 kg CO2 / kg for recycled PET, contributing to India's annual CO2 emissions of 1.8 billion metric tons of plastic-related CO2. The underdeveloped rPET market restricts job creation, innovation, and export potential despite India being the world recycling leader. Scaling of a closed-loop system is essential for India's sustainability goals.

Global PET Recycling Rates Comparison: India leads the world in PET collection, but lags

behind Japan and the EU in scaling closed-loop recycling for bottles.

Distinct Sub-Issues

The barriers to closed-loop PET recycling in India are complex, categorized into four sub-issues:

1. Unsuitable infrastructure for food-grade rPET production: India has over 2,000 baling centers, 105 flake-producing units, and 40 large-scale recycling facilities, but most are mechanical recycling facilities for textiles or other non-food applications. Food-grade rPET can only be produced with advanced technologies such as chemical recycling. Hence, Ganesha Ecopet's Warangal facility produces just 42,000 tonnes of food-grade rPET a year, far less than FMCG companies like Nestle and PepsiCo. The problem is made worse by urban-rural disparities: states like Tamil Nadu and Bihar lack processing units compared to Maharashtra and Gujarat, where 60% of recycling facilities are concentrated. This manual sorting and the use of old mechanical processes used in the informal sector further limit scalability since such methods cannot produce high-purity rPET required for food-grade applications.

2. Contamination of PET Waste: RPET quality degradation due to contamination by residual

liquids (e.g. beverages, oils), labels, adhesives, and other plastics (e.g. PVC, HDPE) degrades

rPET for closed-loop applications. Mechanical recycling accepts 1-2% contamination, whereas informal collection systems result in 5-10% contamination due to poor source segregation. Mixed waste streams in densely populated urban areas like Delhi and Mumbai cause higher contamination rates, while rural areas lack segregation awareness and infrastructure. That causes downcycling, with 73% of rPET being used in non-food applications, such as polyester fibers with lower lifecycle and lower circularity. In addition to processing costs, contamination leads to additional cleaning steps which discourage closed-loop recycling.

4. Inconsistent Policy Implementation: The 2022 Plastic Waste Management (PWM) Rules

require 30% rPET content in PET bottles by 2025 and 60% by 2029, but enforcement varies

widely across states. With 80% compliance among producers, Maharashtra and Karnataka have advanced EPR frameworks, while bureaucratic delays and inadequate infrastructure leave states like Tamil Nadu and Bihar trailing behind. The informal sector dominates EPR compliance as producers cannot trace waste flows through unregistered waste pickers. Unlike the EU's harmonized regulations under the Single-Use Plastics Directive, there are no national standards for food-grade rPET quality, which prevents scalability. The 2024 budget set aside only Rs500 crore for plastic waste management, not enough to fund advanced recycling technologies or infrastructure upgrades across India's regions.

3.Relative Benchmarking

Driven by India's informal sector of over 50 million waste pickers, India's PET collection rate beats that of Japan (72.1%), the EU (50%), and the US (31%). Advanced sorting technologies such as near-infrared scanners and a cultural emphasis on waste separation help Japan achieve a 60% bottle-to-bottle recycling rate with government subsidies for recycling facilities. The EU single-use plastics directive mandates a 30% rPET content and deposit return schemes (DRS), with a 98% return rate in Germany. India, however, recycles only 27% of its closed-loop material, and most of the recycled PET is diverted to textiles due to infrastructure and contamination issues. In the United States, with fragmented municipal systems, 21% of residential PET is recycled, and volumes are sent to landfills. India's informal sector has a unique strength of collecting 1.63 million tonnes of PET annually, but mechanical recycling and a lack of formal integration limit closed-loop outcomes. Introducing formalized waste pickers, advanced technologies, and harmonized policies may put India on the global map for closed-loop PET recycling.

4.Possible Solutions

To meet India's closed-loop PET recycling challenges, we propose detailed, actionable solutions for each sub-issue, drawing on the informal sector, emerging technologies, and policy changes. They seek to improve infrastructure, reduce contamination, increase market demand for rPET, and strengthen policy frameworks with tailored implementation strategies for India's specific context.

Enhancing Bottle-to-Bottle Recycling Infrastructure The Indian recycling infrastructure must move from mechanical to advanced technologies for food-grade rPET production. Proposed solutions include:

Formalize Informal Collection Networks: India's 50,000 waste pickers form the basis of its

global benchmark PET collection rate. Formalizing this role through cooperatives like

Bengaluru's Hasiru Dala model can improve efficiency and integration with formal systems.

Waste pickers get identity cards, training, and social security access - increasing collection yields by 20% in pilot programs with Hasiru Dala. Digital platforms like Recykal's blockchain-based traceability system can track PET waste from collection to processing, ensuring a consistent supply for closed-loop recycling. By 2028, securing 30% more food-grade PET supply nationwide would create 100,000 additional jobs for waste pickers. Training on segregation, safety, and digital tools can improve productivity, while cooperatives can negotiate better prices for collected PET, taking into consideration labor exploitation.

Chemical Recycling Facilities - Invest now! Chemical recycling technologies, such as glycolysis and methanolysis, produce food-grade rPET with a purity of 2-27% compared to mechanical methods. Examples of scalability are facilities like Revalu Resources' Nashik plant, which processes 100 million bottles per year. By 2030, public-private partnerships such as those proposed in the 2024 Budget can fund 10-15 new chemical recycling plants each costing USD 10-15 million. They must come first in industrial centres like Gujarat, Maharashtra and Telangana, where 60% of India's recycling infrastructure is located. By 2027, for instance, FMCG companies like PepsiCo would process 200,000 tonnes of PET annually at Reliance Industries' planned chemical recycling facility in Jamnagar. Government incentives like 50% capital cost subsidies may draw private investment while tax breaks on recycled products may reduce initial costs.

- Large Scale Deposit Return Schemes (DRS): Piloted in Maharashtra and Karnataka, DRS

programs achieve 85% return rates by rewarding consumers with Rs5-10 deposits per bottle. A national DRS modeled after Germany's return system, which has a return rate of 98%, would raise closed-loop feedstock by 40% in two years. Vendor networks like Reliance Retail and DMart can host collection points with mobile apps or vending machines to ease returns. Government mandates - enforced through the Central Pollution Control Board - can ensure retailer compliance and public awareness campaigns can increase participation in urban and semi-urban areas. Cities like Delhi and Chennai could pilot another 500,000 tons of PET per year for bottle-to-bottle recycling.

Reducing Contamination: Contamination is the major barrier to food-grade rPET fabrication for closed-loop applications. Proposed solutions include:

Consumer Education & Standardized Labeling Educating consumers on proper segregation

reduces contamination by 15% through public awareness campaigns like Mumbai's "Recycle

Right" initiative. Bureau of Indian Standards IS 14534: 1998 mandates clear recycling labels on PET bottles, but few comply - especially small manufacturers. National campaigns leveraging social media platforms like Twitter, Instagram, schools and the Swachh Bharat Mission can promote source segregation with a 20% reduction in contamination by 2027. Standardized "Recycle Ready" logos, used in the UK, can help consumers remove caps, labels and residual liquids before disposal. Awareness is low outside urban areas, so rural outreach programs in partnership with NGOs like Goonj are crucial.

- Advanced Sorting Technologies: AI-enabled sorting systems like AMP Robotics' near-infrared scanners can reduce contamination to less than 1% compared to 5-10% with manual sorting. Adding such systems to India's 105 flake-producing units would boost food-grade rPET output by 250,000 tonnes annually by 2028. Pilots of Delhi material recovery facilities (MRFs) report higher PET recovery rates with AI. State subsidies - 50% of the USD 1-2 million cost per system - could speed up adoption in states like Gujarat and Uttar Pradesh, which together have 40% of India's recycling units. Partnerships with technology providers like Tomra can increase AI system localization by 10%.

- Enzymatic Recycling: Enzymatic hydrolysis is used by Carbios to tolerate up to 10%

contamination to yield food-grade rPET. Pilot plants supported by FMCG firms like PepsiCo and academic institutions like IIT Bombay in India could process 50,000 tonnes annually by 2028.

Development of low cost enzymes through R1and1D investments can reduce processing costs by 15% and make enzymatic recycling competitive with mechanical methods. Suppose a pilot plant in Hyderabad supplies rPET to local beverage manufacturers, creating a closed loop.

Increasing market demand for food-grade rPET.

Increasing rPET demand is required to make closed-loop recycling economically viable.

Proposed solutions include:

Mandate Recycled Content Targets: A 30% rPET by 2025 mandate under the 2022 PWM Rules has spurred adoption - Hindustan Unilever uses 90% rPET in some products, including shampoo bottles. Tax incentives like a 5% GST reduction on rPET products could help plug the cost gap with virgin PET (USD 1,300-1,500 / tonne vs USD 1,000-1,200 / tonne). States like Karnataka, with advanced EPR frameworks, can pilot higher targets (50% by 2027) and nationwide enforcement through CPCB audits can drive the demand for PET up to 30% by 2028. For example, requiring 50% rPET in all PET bottles could drive demand for 800,000 tonnes annually and encourage investment in recycling infrastructure.

- Expand rPET Applications: Beyond bottles, RPET is used for food-grade packaging (trays,

containers), films, and textiles. Exportation of rPET by Ganesha Ecosphere to 18 countries

shows market potential with a revenue of USD 500 million annually. With R1and1D investments supported by the Department of Science and Technology, new applications like rPET-based food trays could capture 10% of India's $5 billion packaging market by 2030. Collaborations with packaging manufacturers like Uflex can scale production without relying on bottle-to-bottle recycling.

- Brand Partnerships: Collaboration with FMCG giants like Nestle, Coca-Cola, and Parle Agro, which pledged to increase the use of recycled PET by 50% by 2030, could stabilize demand. RPET supply contracts, such as those of revalyu Resources' partnerships, may hedge supply chain risks. Industry associations like All India Plastic Recycling Association can facilitate such partnerships and ensure consistent quality and supply. For example, a group of FMCG companies would buy 500,000 tonnes of rPET annually to gain economies of scale and cut costs by 10%.

Strengthening Policy Frameworks

Robust policies are crucial for scaling closed-loop PET recycling. Recommendations include:

- Uniform EPR Implementation: The 2022 EPR framework mandates producers recycle 30% of PET by 2025 and 60% by 2029. Uniform enforcement across states, supported by a national EPR portal like the CPCB's, can track compliance and penalize non-compliance. Maharashtra's model of 80% EPR adherence can help states like Tamil Nadu and Bihar which have less than 50% compliance. Regular audits and Rs1-5 lakh fines for non-compliant producers can bring accountability and raise recycled PET supply by 25%.

- Incentivize Technology Adoption: The 2024 budget allocation of Rs500 crore (USD 60

million) for plastic waste management could fund chemical recycling and AI sorting

technologies. The 50% subsidy could attract private investment, as seen in Gujarat's recycling parks, which host 20% of India's facilities. Tax breaks for companies adopting advanced technologies could accelerate deployment by 20 new plants a year processing 100,000 tonnes of goods by 2030.

- Harmonized rPET Standards: Food-grade rPET in accordance with national standards can

support exports and maintain quality. RPET for food contact can be certified by the Food Safety and Standards Authority of India (FSSAI), enabling market confidence and exports of USD 1 billion by 2030. Working together with international bodies like the UN Environment

Programme may bring global alignment and help India position itself in the petrochemical trade.

5.Implementation Considerations

Stakeholders can implement solutions alone or jointly. Businesses like Ganesha Ecopet and

Revalyu Resources can pilot DRS and chemical recycling plants for a cost of USD 50-100

million over five years. Municipalities could finance AI sorting systems through EPR revenues and have 50 MRFs by 2028. NGOs like Goonj and Saahas can lead consumer education campaigns using platforms like the Swachh Bharat Mission to reach 100 million homes. Fellows interested in implementation might target scalable pilots like city-level DRS in Bengaluru or enzymatic recycling in Gujarat, for which GGI may not provide direct support. Governments, businesses and communities need to coordinate incentives. For instance, public-private partnerships can fund half of new recycling plants, and NGOs can train 1 million waste pickers by 2028 - creating a closed loop ecosystem.

6.Conclusion

India's 95% PET recycling rate and its informal sector of 50,000 waste pickers make it a world leader, but open-loop recycling into textiles dominates the circular economy benefits. Given adequate infrastructure, contamination, low rPET demand, and inconsistent policy implementation, India could scale closed-loop recycling to 50% bottle-to-bottle recycling by 2030 in line with the 2022 PWM Rules' 60% rPET goal by 2029. Solution suggestions included formally registering waste pickers through cooperatives, introducing chemical and enzymatic recycling, introducing DRS to increase collection, requiring recycled content, and uniformly enforcing EPR across states. Charts highlight strengths in collection and gaps in closed-loop recycling compared to Japan (60% bottle-to-bottle) and the EU (30% for RPET mandates). They highlight technology and policy needs. The expected growth of the rPET market from USD 10.67 billion in 2023 to USD 17.53 billion in 2030 is economically attractive. High technology costs (USD 10-15 million per plant), data gaps in the informal sector, and regional policy differences - especially in Tamil Nadu and Bihar - are challenges. Future research should focus on cost-benefit analyses of chemical recycling, digital traceability for waste pickers, and consumer behavior interventions for better segregation. Using its recycling ecosystem, India can drive the global PET recycling revolution, leading to lower GHG emissions, creating jobs, and providing economic opportunities in line with SDG 12 (Responsible Consumption and Production).

7.Limitations and Challenges

This work is based on secondary data with little information on India's informal recycling sector, which accounts for 95% of PET collection. High capital costs for chemical recycling and AI sorting technologies ($10 - $15 million USD per plant) discourage adoption in

resource-constrained states like Bihar and Uttar Pradesh. Regional policy differences -

compliance rates ranging from 80% in Maharashtra to 50% in Tamil Nadu - hinder EPR

enforcement. Consumption behavior is variable, with low segregation awareness in rural areas contributing to contamination levels. Such rapidly evolving recycling technologies as enzymatic hydrolysis might outpace known results and require continued research. Innovative financing models like green bonds and localized strategies are needed to overcome these barriers and ensure scalable implementation.

Meet The Thought Leader

Laboni is a mentor at GGI and is currently working at The Bridgespan Group as a Senior Associate Consultant. She takes interest in socioeconomic development issues, public policy, and equity across different vectors of gender, caste, class, and ability, which in turn fuelled her transition from working at a global bank to the social sector. She is an Urban Fellow from the Indian Institute for Human Settlements, Bangalore and has a bachelor's degree in Economics from St. Stephen's College, University of Delhi.

Meet The Authors (GGI Fellows)

Aswath S comes from a family business background in manufacturing and sustainability through Aswath Polymers, where he has witnessed firsthand how industries grapple with balancing growth and environmental responsibility. These experiences nurtured his curiosity about how circular economy models can help businesses remain competitive while reducing their ecological footprint. Currently pursuing Business Administration at NMIMS, Mumbai, he combines academic learning in marketing and strategy with practical exposure to operations and sustainable product design.

His work in the polymer sector, particularly on innovations like lightweight bottles and recycling systems, has shaped his interest in advancing India’s circular economy. This commitment also inspired his research paper on closed-loop PET recycling in India, which explores the country’s unique challenges and opportunities in scaling bottle-to-bottle recycling. Both his professional experience and academic inquiry reflect a common thread: a deep conviction that sustainability is not only an environmental imperative but also a driver of long-term economic value. Looking ahead, Aswath aspires to work at the intersection of business, sustainability, and policy, designing strategies that enable India to lead in sustainable plastics management while fostering inclusive economic growth.

If you are interested in applying to GGI's Impact Fellowship program, you can access our application link here.

References

1. Anonymous. (2024). India’s PET recycling industry, represented by the All India Plastic

Recycling Association. The Hindu. https://www.thehindu.com

2. Uekert, T., et al. (2023). Technical, Economic, and Environmental Comparison of

Closed-Loop Recycling Technologies. ACS Sustainable Chemistry & Engineering.

3. Anonymous. (2019). India Recycled PET (r-PET) Bottles Market. Maximize Market

Research. https://www.maximizemarketresearch.com

4. Anonymous. (2024). India recycles 95% of used PET bottles. Fortune India.

5. Anonymous. (2020). Recycling in the U.S. Is Broken. How Do We Fix It? State of the Planet.

6. Anonymous. (2022). PET Recycling in India - Trends and Opportunities. comPETence

Magazine. https://www.petnology.com

7. Anonymous. (2024). The upcoming legislation mandating 30% rPET content in beverage

bottles. Cirplus. https://cirplus.com

8. Anonymous. (2021). PET Bottle Scrap Regulations in India. Recykal. https://recykal.com

9. Anonymous. (2017). India recycles 90% of its PET waste. Hindustan Times.

10. Anonymous. (2023). Sustainability Report 2023. Hindustan Unilever. https://www.hul.co.in

11. Anonymous. (2024). Ramp-up continues for India’s bottle-to-bottle recycling. Recycling

International. https://recyclinginternational.com

12. Anonymous. (2023). Life cycle assessment and circularity of PET bottles. ScienceDirect.

13. Anonymous. (2024). 2024 Budget: Impact on India’s Plastic Recycling Industry. Banyan

Nation. https://www.banyannation.com

Comments